“A Paradigm Shift” - How hearsay empowers financial advisors to build authentic relationships with customers

Time to read:

Planning for your financial future is a big task—even in the best of times. Navigating complex matters like portfolio management and life insurance policies requires an authentic, human touch. With this in mind, Hearsay built a financial services client engagement platform that helps advisors leverage digital channels to maximize their reach to prospects, optimize client engagements, and deliver exceptional service in a compliant manner.

Over 100 of the world’s leading enterprise financial firms, like American Family Insurance and Charles Schwab, rely on Hearsay’s platform to equip their advisors with the tools they need to guide clients through some of their most important financial decisions—especially during uncertain times.

After establishing a leading social media and website tool for the financial services world, Hearsay sought to empower their customers to develop deeper client connections with more personal, 1-to-1 channels like voice and SMS. When uncertainty comes to pass, Hearsay’s customers need to be there for clients at a moment’s notice.

Empowering remote and hybrid advisors

During the recent global shift to remote work, many enterprise banking, wealth management, and insurance organizations decided to move away from corporate-provided devices and instead permit employees to communicate with customers from their own mobile phones or laptops. Serving enterprise customers with tens of thousands of clients, Hearsay needed a solution to quickly and compliantly build new channels for texts and calls— all while ensuring a smooth transition for enterprise field teams.

The company chose Twilio for its ease of integration and multichannel offering that leaves room to build, explained Product Marketing Lead, Will Warren.

“Twilio’s technical excellence and scalable platform really lets us focus on what we do best—delivering client engagement tools purpose-built for financial services. One of our key differentiators is the ability to layer on compliance and supervision capabilities to meet our customers’ regulatory requirements. It’s really only when this criteria is met that business leaders like Chief Compliance Officers feel the confidence needed to empower client texting within an institution” Warren said.

Using Twilio Programmable Messaging and Programmable Voice, Hearsay enables more than 200,000 financial advisors to provide secure guidance to their customers— with the flexibility to use their personal devices. This results in saving millions in operating costs for enterprise organizations and empowers field reps to work from home without having to rely on company devices, explained Warren. One firm that implemented Hearsay’s texting solution achieved a return on investment (ROI) of nearly 400% due to operational efficiencies, improved risk mitigation, and increased client acquisition and retention.

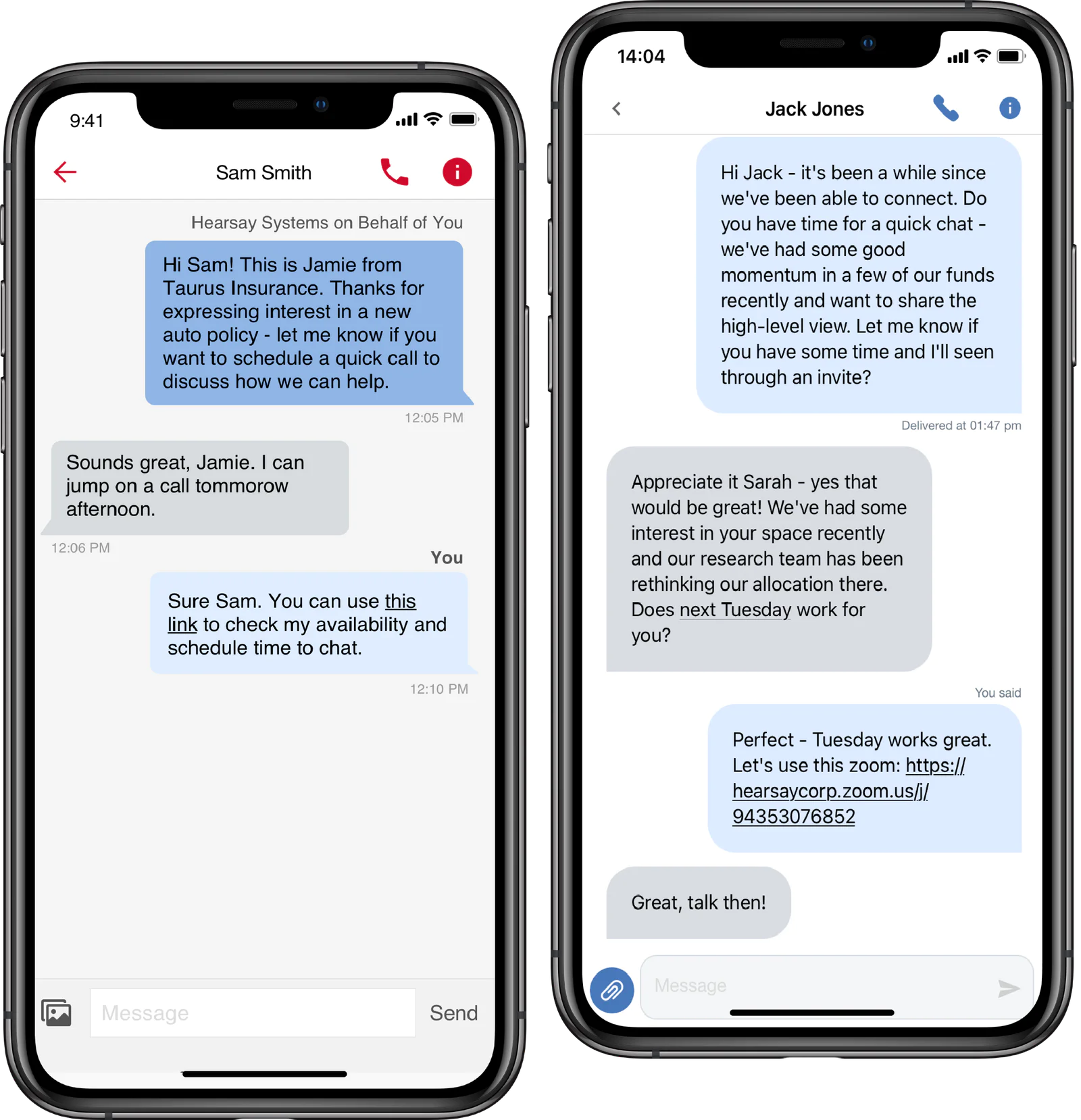

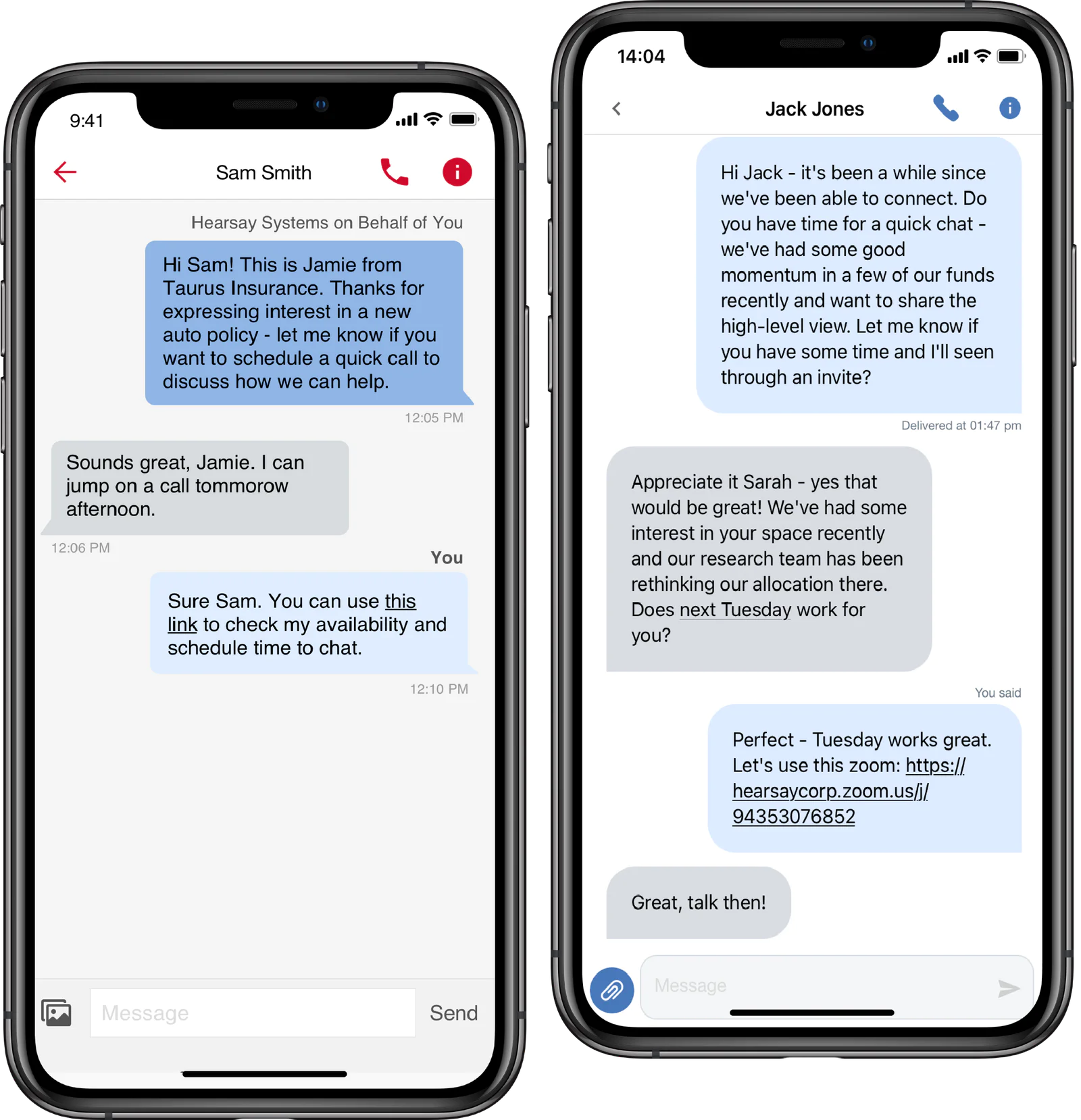

With Twilio, the process of managing phone numbers is simple. Companies can easily purchase and provision a new phone number or equip an existing network number with text and voice support. Each agent has a unique number, which is branded by the organization for easy customer recognition. Follow-ups are convenient, as customers can call their advisor from the same number they receive texts. Proxied phone numbers anonymize the conversations to maintain privacy and compliance.

Twilio Programmable Voice makes it easier for financial advisors to do their jobs. Call tracking automatically documents customer calls and text messages, and VoIP allows advisors to place calls from anywhere or any device with an internet connection. Additionally, Hearsay’s customers have made significant productivity gains by leveraging their delegation capabilities. With this feature, firms delegate representatives to text on behalf of financial advisors, freeing up advisors’ time and increasing client engagement frequency by nearly 7x.

A new way to connect with clients

For Hearsay, implementing Twilio Programmable Messaging to its platform has been nothing short of a game changer—offering its financial services customers the ability to reach their clients by text for the first time.

“Complex regulatory requirements meant that most of our customers did not previously have an enterprise SMS program in place. Working with Twilio allowed us to quickly deliver this channel. When you think about the impact on communication, it’s been a paradigm shift for our customers,” said Steven Latow, Hearsay’s Platform team lead.

Some advisors are getting immediate responses for the first time via SMS— a welcome change from other channels where clients rarely followed up. In fact, advisors frequently see reply texts from customers in less than 10 minutes, explained Latow.

“The ability to rapidly deploy an SMS channel in the midst of a pandemic provided relief for our customers. Almost overnight, it became a critical tool to engage their clients more regularly and effectively,” added Warren.

Most importantly, these new channels help advisers reassure clients about the safety of their financial futures. Research indicates that clients leave their advisors not because of performance, but rather for failure to connect in the moments that matter.

With the ability to integrate CRM platforms, Hearsay’s enterprise financial services customers can ensure they are connecting with clients when it matters. The automatic capture of advisor texting and calling data provides a richer view of the client journey. This data informs intelligent workflows that power automated outreach for new and existing clients, with meaningful results. Firms have seen a boost in response rate and a 37% increase in lead conversion when leveraging the full power of Hearsay and Twilio’s platforms.

Last year, Hearsay facilitated over 3.1 million texts and 2.4 million mobile calls between its customers and their clients. End-customers can rest easy knowing a trusted conversation with their financial advisor is only a call or text away.

A solid foundation with room to build

Now that Hearsay has established dependable lines of communication for its customers alongside Twilio, the company is creatively building additional ways to help advisors connect with clients.

Hearsay soon plans to add new channels to its repertoire to offer end customers more choice in how they communicate with their financial advisors. Using these new Twilio-powered channels, Hearsay is also focused on upleveling its customers’ success. “We’re building a prescriptive guide informed by data and industry knowledge to teach advisors when and how is best to engage end-customers to take their performance to the next level,” explained John Barkis, Product Team Lead at Hearsay.

"Twilio’s technical excellence and scalable platform really lets us focus on what we do best—delivering client engagement tools purpose-built for financial services."